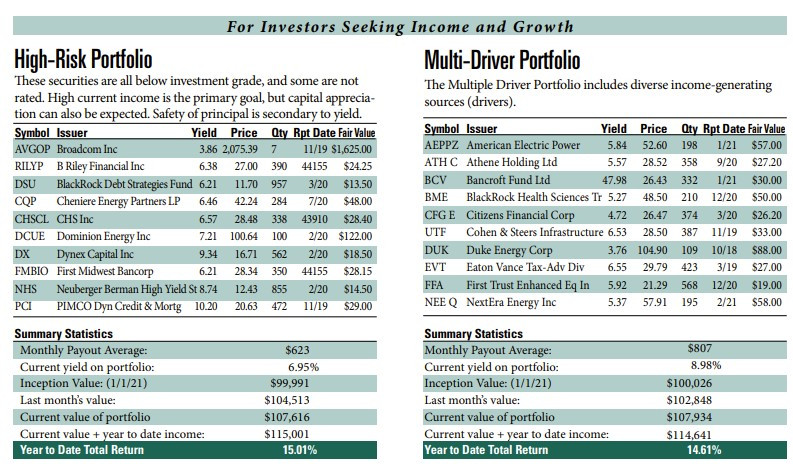

The ISI newsletter includes investment recommendations for preferreds versus bonds, preferred stocks, closed-end funds, common stocks, mandatory convertible preferred stocks, and master limited partnerships. Over the last 10 years, the ISI Model Portfolios have delivered high current income and protected investors’ principal. One dollar invested in our Medium Risk Portfolio would be worth $2.21 at the end of the 2021 year. One dollar invested in the ICE BofA US Corporate Index over the same period would be worth only $1.59.

Preferreds versus Bonds:

Preferred stocks offer many of the same benefits as bonds, including fixed payments and relatively low risk. However, preferred stocks also offer some important advantages over bonds, such as the potential for price appreciation and greater income generation. For these reasons, we believe that preferreds are a more attractive investment than bonds at current levels.

Preferred Stocks:

Preferred stocks are a type of equity that entitles holders to receive fixed quarterly dividends before common shareholders. Preferred also typically has priority over common stock in terms of dividend payments and asset liquidation. Given the current low-interest rate environment, we believe that preferreds are an attractive investment option for income-seeking investors.

Closed-End Funds:

Closed-end funds are a type of mutual fund that is not exchange-traded. Closed-end funds typically trade at a discount to their net asset value (NAV), which provides investors with an opportunity to purchase shares at a bargain price. In addition, closed-end funds often offer higher levels of income than open-end mutual funds due to their use of leverage. For these reasons, we believe that closed-end funds offer an attractive investment opportunity at current levels.

Common Stocks:

Common stocks are the most basic form of equity ownership and represent ownership in a publicly traded company. Common stockholders are typically entitled to vote on corporate matters such as board elections and major corporate decisions. They may also be entitled to receive dividends, although this is not guaranteed. Common stocks tend to be more volatile than other types of investments but may offer greater potential for capital appreciation over time. Given the current economic environment, we believe that common stocks offer an attractive investment opportunity for long-term investors with a high degree of risk tolerance.

Mandatory Convertible Preferred Stocks:

Mandatory convertible preferred stocks are a type of equity that pays regular dividends and generally has voting rights attached to it like common stock. However, unlike common stock, mandatory convertible preferred shares must be converted into common stock at a predetermined date or event. This conversion feature makes mandatory convertible preferreds an attractive investment option for income-seeking investors who are interested in owning shares of a particular company but do not want to shoulder all of the risk associated with owning common stock outright.

Master Limited Partnerships:

Master limited partnerships (MLPs) are a type of partnership that is publicly traded on major exchanges like common stock but has special tax treatment under U.S. law (MLPs are not subject to corporate income tax). MLPs typically own and operate energy infrastructure assets such as pipelines and storage facilities. Given the current low-interest rate environment, we believe that MLPs offer an attractive investment opportunity for income-seeking investors who are looking for tax-advantaged yield.

With interest rates expected to rise, we recommend rotating out of bonds and into preferreds, adding exposure to preferred stocks, investing in closed-end funds, buying common stocks from quality companies, picking up mandatory convertible preferred stocks, and investing in master limited partnerships. All of these investments offer a high current income with the potential for price appreciation as well. Do you have any questions about these recommendations? Contact us today and one of our experienced investment advisors will be happy to assist you further or call us at 1 800-785-7090.